By Ahsan Ali

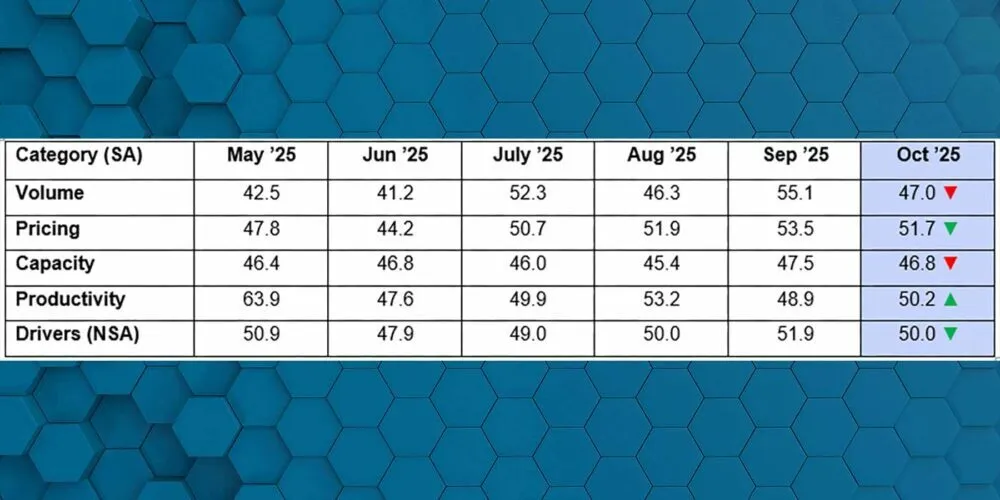

A new report from ACT Research shows the trucking industry lost momentum in October 2025, with both freight volumes and capacity pulling back. The findings suggest the sector is working through a short-term imbalance as it adjusts to shifting demand and lingering industry pressures.

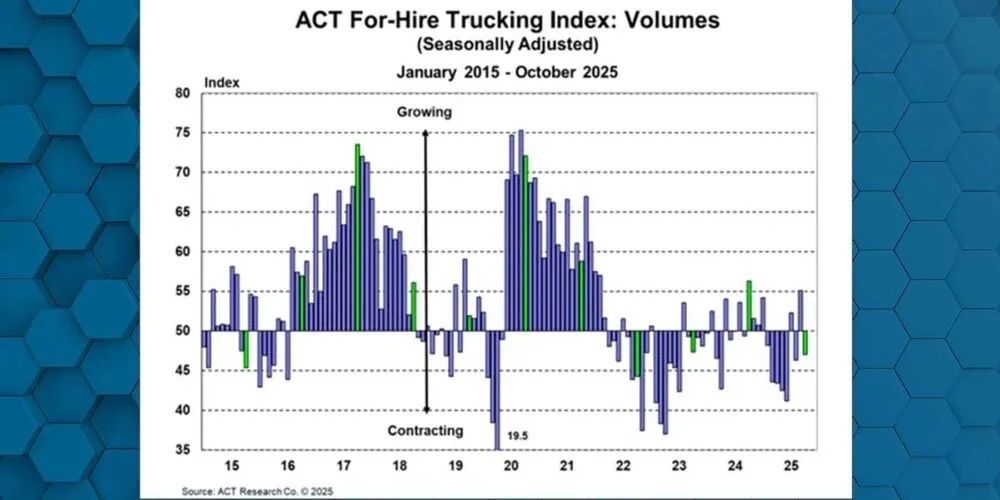

Volume Index

Freight movement slowed noticeably in October. ACT Research’s seasonally adjusted Volume Index dropped 8.1 points to 47.0, reversing course after hitting a 13-month high of 55.1 in September.

Carter Vieth, a research analyst at ACT Research, said the decline reflects a natural cooldown after many companies moved freight earlier than usual. Even though consumers are still spending, he explained, trucking companies and equipment suppliers are describing a softer holiday season. Major freight-producing industries, such as manufacturing and housing, are either stalled or slipping. While data centers are booming, he noted, their impact on freight remains small. Vieth said the current uneven pace of freight activity should only be temporary, similar to the shifts seen before tariffs were put in place earlier this year.

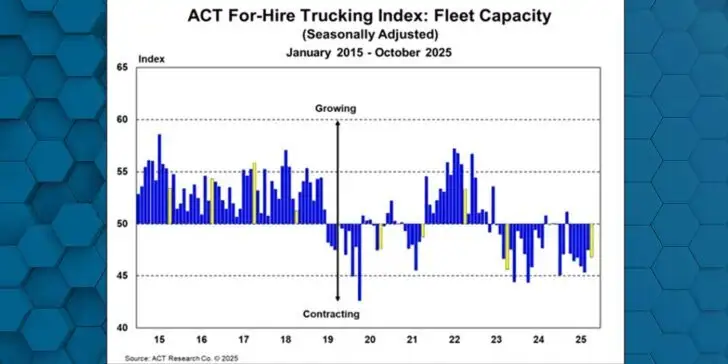

Capacity Index

Trucking capacity tightened again in October. The Capacity Index dipped by 0.7 points, falling from 47.5 in September to 46.8.

Vieth pointed to weak profits as a key reason capacity continues to shrink, especially as private fleets scale back and smaller operators close their doors. Uncertainty around tariffs and regulations is also causing fleets to delay new equipment orders. However, he noted that recent changes from the American Trucking Associations on low-NOx rules could encourage some companies to resume investing.

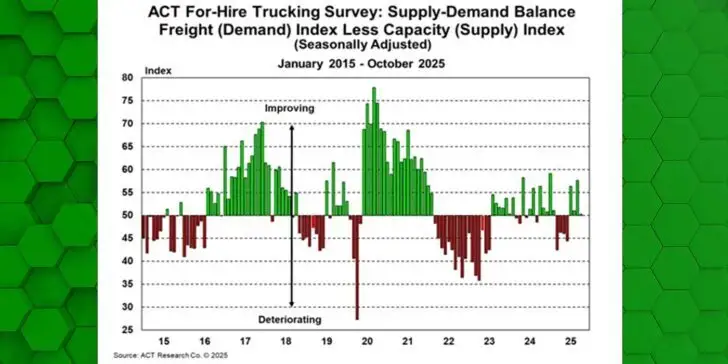

Supply-Demand Balance

The overall balance between trucking supply and demand also weakened. The Supply-Demand Balance slid from 57.6 in September to 50.3 in October, mainly due to softer freight volumes after earlier pull-forward shipments created a slowdown heading into the fourth quarter.

Vieth said he does not expect conditions to steady right away. The industry may need several more months to work through the effects of the pre-tariff rush. As inventories built ahead of tariffs run out, goods prices could rise, even though tariff cuts are starting to roll in. While shrinking capacity could help cushion the drop in demand, Vieth added that lower tariffs and the eventual end of the payback period may open the door to a rebound later on.

Author Profile

-

Ahsan Ali is a technology and business journalist who covers the latest developments in autonomous vehicles and innovative startups.

With a sharp eye for industry trends, he breaks down complex tech stories into clear, engaging insights for general readers.

Latest Entries

Business3 months agoTrucking Safety Reforms: New Plan Targets Industry Risks

Business3 months agoTrucking Safety Reforms: New Plan Targets Industry Risks Business3 months agoOctober 2025 Trucking Slowdown Hits Freight and Capacity

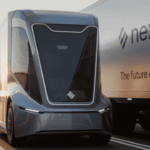

Business3 months agoOctober 2025 Trucking Slowdown Hits Freight and Capacity Business3 months agoAI Electric Trucking Startup NexDash Raises €5M

Business3 months agoAI Electric Trucking Startup NexDash Raises €5M Business3 months agoTrucking Industry Crisis: New Rules Threaten U.S. Supply Chain

Business3 months agoTrucking Industry Crisis: New Rules Threaten U.S. Supply Chain